- The Cautionary

- Posts

- Greed-to-Grief, No. 13

Greed-to-Grief, No. 13

Early Jeffrey Epstein Ponzi Scheme Costs People Millions

Unless you grew up on another planet, you have probably had an experience with a collection agency.

Agencies are easy to set up: You need a printer to produce nasty letters and a room with telephones staffed with people who are good at being pushy and rude.

Simple business, right?

Debt collectors being pushy and rude

But how does a collection agency actually make money?

Say you are a business like a hospital where you trying to collect from former patients who will likely use your services again, so you really don’t to be pushy and rude with them.

You make a few phone calls as the patient’s balance ages. One call to remind them the balance is 30 days late, another call at 60 days, and another at 90 days. No response and no payments so you “send them to collections.”

Every industry has its own “collectability curves,” or schedules that indicate the average amount collected as an individual balance ages. In our hospital example, once a patient balance hits 90 days, the expectation is a collection of 14% of the original balance. Ouch!

So, the hospital takes hundreds of these 90+ day balances, bundles them together and sells them to a collection agency.

The agency pays the hospital immediate cash equal to something like 5% of the balances and the agency now owns those balances and can start the nasty letter-pushy and rude phone cycle. If the agency can collect more than 5%, the agency makes profit.

Fortunes have been made in the collection agency business, but let’s talk about Towers Financial, which at one time was one of the most significant agencies around.

Towers Financial CEO Steve Hoffenberg

Towers never-modest CEO, Steve Hoffenberg, built Towers into a behemoth by specializing in the collection of medical debt.

Towers would borrow hundreds of millions then use the proceeds to purchase portfolios of overdue medical debt, like the 90+ day overdue hospital accounts.

As long as Towers was making enough of a spread on the purchased portfolio, it could pay its pushy and rude workforce and pay the interest owed on all the money it borrowed. The spread is the difference between what Towers paid for the debt (5%) and what it collected (hopefully more than 5%).

To recap with an example: Towers borrows $100 million by issuing bonds purchased by individual investors. Towers uses the $100 million to purchase a block of overdue accounts from a hospital for 5% of their face value (this means that the accounts have a face value of $2.0 billion!).

As long as Towers collects $100 million plus the costs of interest on that $100 million, plus the costs of the pushy and rude speed dialers, Towers makes a profit.

Collections may be an unsavory business, but it is an excellent business model that is easy for investors and lenders to understand, unless the agency lies about the actual results, which Towers did.

But Towers did not start out that way. It was a legitimate collection agency for more than 10 years before Hoffenberg met Jeffrey Epstein.

Yes, the Jeffrey Epstein who accumulated a mysterious fortune and was twice convicted of sex crimes involving minors and the same Jeffrey Epstein who committed suicide in prison but still haunts President Trump to this day as result of an Epstein and Trump bromance from years ago.

Although he was a willing participant, Hoffenberg (right) blames Epstein (left) for devising the Ponzi Scheme that took down Towers Financial

With Epstein on board, Towers started borrowing larger sums of money and purchasing more debt to collect.

Hoffenberg acquired the requisite signals of success, including the private jet, Manhattan townhouse, and a Long Island Mansion. He told everybody, all the time, how rich he was.

It seemed that Hoffenberg always wanted the good life. Years earlier, he pled guilty to second-degree larceny for trying to steal a diamond ring.

The problem Hoffenberg had at Towers was not the ability to raise money to purchase overdue accounts, but was that his people were not pushy or rude enough.

He borrowed a lot of money, bought a lot of debt, but did a lousy job with the core of the business: Towers did not collect enough of the overdue accounts. It was paying more for the accounts than it could collect. Towers had negative spreads.

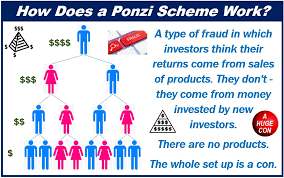

Undeterred, Hoffenberg kept borrowing money and purchasing portfolios of overdue accounts. With Epstein’s help, he turned Towers into classic Ponzi Scheme.

He used new borrowings to pay off old borrowings since the underlying business was not generating any profit.

You can get away with a Ponzi for a short time, but after a while the falsified financial statements, improper accounting, and constant need for more cash catch up to the mastermind of the Ponzi and the house of cards collapses.

In the end, more than 200,000 investors in Towers’ debt lost almost a half a billion dollars when the Ponzi collapsed. Hoffenberg was sentenced to 20 years in prison. And somehow, Jeffrey Epstein walked away with no consequences.

Key Takeaways

Why invest your hard-earned money with a guy who previously pled guilty to larceny?

Beware the CEO self-promoter and status-seeker. I prefer the CEOs who drive Hondas and stay out of the society pages.

I always look at a business and assume it is a Ponzi Scheme, until it is proven otherwise. Fortunately, most of the time the businesses are real.

Things I think about

Every year, about 75 Ponzi Schemes involving several billion dollars are busted. Recent trends indicate church groups and other close-knit communities are primary targets as the schemers pose as members of such groups.

Recommended reading

Pandora’s Lab

Seven stories of science gone wrong

The Psychology of Money

Lessons on money and life. I have given this book to a dozen people.

The days when Elon Musk was cool

One of our most popular posts.

Remarkable People Podcast

Hear from real thought leaders across culture, big issues, and anything else important.

The Billionaire’s Apprentice

Insider trading and the downfall of Raj Gupta, former chair of McKinsey & Co.

Black Jack Strategy Card

Same strategy used by the pros

The Cult of We

Adam Neumann and the great illusion of WeWork

See the full reading list here.